The Cost of Time

It has been over five months since our last Ballast Letter. I would love to tell you that we went quiet because nothing worth noting has happened in the broader market, but the truth is we have just been very busy. Our hope is to write these Letters with more consistency going forward.

I want to discuss the impact of the current rate environment on small businesses, through the lens of our clients. Admittedly, it’s sometimes hard to see the translation of macro conditions to our clients. Further, we are sensitive to the fact that discussions on boarder market concepts can feel distant and academic to our clients. Bear with us however on this topic, because I can assure you it is not just an academic exercise. We are seeing a very real change in how our clients operate their businesses in response to the change in rates over the past twelve months.

The Shifting Environment

As you likely well know, interest rates have been steadily rising since early last year. The ‘why’ behind this increase is not the subject of this Letter. We have gone into the details and explanations in past Letters and can provide those upon request. Instead, today we want to talk about the impact of these higher rates on our clients, and we can break that impact into two major categories – there is the financial impact on a client’s P&L (this result is obvious) and there is also the broader impact on focus, tone, and management. For now, we can just call this behavioral impact.

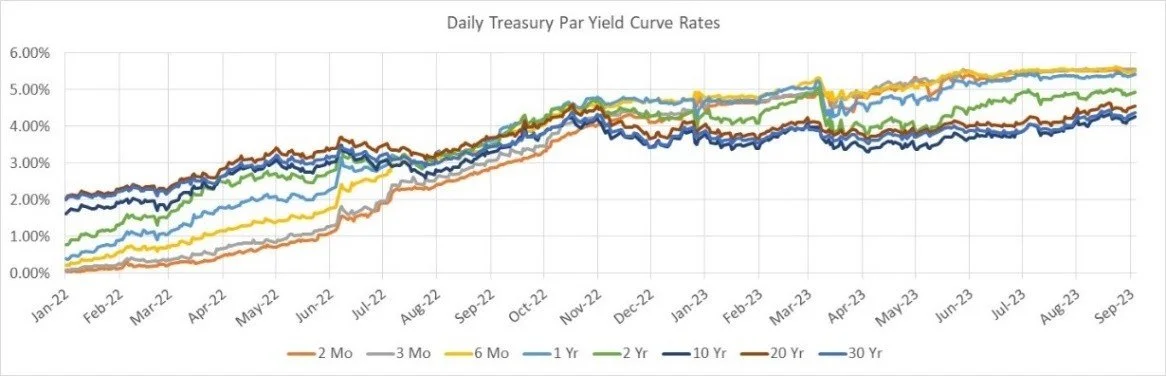

Let’s start by establishing context. See the below charts for the yields on a variety of treasuries as well as the Effective Funds Rate, Secured Overnight Financing Rate (“SOFR,” which is effectively the new LIBOR), and Prime. Each of these rates has its purpose or use or function but the main thing to note is that each rate has materially increased since the beginning of 2022. Rates have risen and this has created operating conditions the likes of which we have not seen in almost fifteen years.

Financial Impact

The financial impact of these higher rates is well documented, oft discussed, and probably very front-of-mind for our clients. For those with floating or variable rate debt, the increase in rates has immediately increased the interest expense on this debt. For those with fixed rates on their debt, there is no immediate increase in cost but there is an expectation, if rates do not decrease, that the cost of this debt will increase in the future. For those with net cash positions, rising rates are providing a material increase in interest income on this excess cash. In short, this rise in rates will negatively impact net borrowers and positively impact net savers.

This financial impact has driven and will continue to drive our clients to work with their banks to mitigate the impact of these increases (extension of lines, adjustment of terms, etc.). As we have discussed in past Letters, treasury management has become a newfound function for a lot of our clients. We now see more attention paid to cash and especially excess cash (to be moved into a savings account for example). The financial impact is something we can understand, analyze, predict, and forecast. The financial impact is important, but we’re seeing something else under the surface which has had a more material impact on our clients’ businesses.

Behavioral Impact

Outside of the financial impacts of higher rates we are seeing a noticeable change in how we and our clients approach decisions. We are seeing a change in tone, direction, and focus. I have no doubt that this change is driven by the change in rates, or the downstream effects of rate changes, but to understand it we will have to discuss interest and rates of return more holistically. I will reiterate that on the surface this other impact can feel philosophical, but I assure you this is not the case, so please bear with me.

Interest Rates Accelerate (and Decelerate) Time

Interest, at its heart, is the cost of time. Interest is not a modern invention, its origins date back to pre-history. Some historians suggest the origins relate to the growth in animal herds or growth in timber stands over time. Regardless of its origins, its fundamental definition is the same: interest is the cost of capital over time. The longer one holds a loan, the more interest one pays. The higher the risk of repayment, generally the higher the rate of interest charged or assigned.

It helps me to think of debt and interest as measures of time, of a manipulation of time, and of the cost of time. In the absence of outside capital, when a business looks to grow (and that growth requires capital), capital must come from retained earnings, or cumulative net profit. The rate of growth of a business then is dictated by the ability to generate profit and plow those profits back into the business. In the absence of outside capital, this is how businesses would function. Now introduce debt into this example. Debt provides an immediate inflow of capital; it is a form of acceleration of time because it provides what would have taken years to generate via profit. Debt warps and manipulates time; it accelerates time. The cost of this manipulation is the interest expense. Interest is what a business pays to accelerate future capital to today.

Cheap Interest Accelerates Time / Decreases Competitive Barriers

Acceleration of time may have a cost, but it also has a benefit, it can allow a business to lay claim to markets and box out competitors, it can allow a business to invest in technology that produces a higher quality experience for its clients. Debt can provide the capital needed to corner resources and invest in training. But note, loading up on debt to accelerate time does not provide value to an organization unless the benefit and value of the acceleration more than offsets for the cost (interest expense) and risk (fixed payments and potentially covenants).

Now consider what happens when interest rates decrease over time. When rates decrease, the cost of this time acceleration decreases; the cost of accelerating capital inflows decreases. The result is that businesses can afford to pull from farther into the future. Cheap debt expands the time horizon.

Cheap debt means businesses can pull more of the future forward to today. When more companies have access to cheap debt, they make decisions to accelerate their growth, increasing competition via the ‘race to grab market share’ – the entire venture capital-backed strategy of ‘blitz-scaling’ is predicated on this low-interest rate opportunity. It becomes a necessity for all companies to do this because their competitors have equal access to the capital, and they will be left behind without using this strategy.

Costly Debt Decelerates Time / Increases Competitive Barriers

Now consider what happens when this trend reverses. As the cost of capital increases, it increases the cost of accelerating future capital. Firms respond by not going so far into the future. They take less debt; they accelerate shorter time periods. The time horizon shrinks. Think of debt and interest rates then as levers used to expand the time horizon and pull forward future capital, and shorten the time horizon and decelerate the pull of future capital.

Also converse to a low-rate environment, competition decreases as rates increase. Capital-related barriers to entry increase because companies that cannot self-fund their growth with internal profits cannot grow nearly as fast (if at all). Because companies will focus more about generating near-term cash flow, innovation through R&D (an activity that often has a ‘long-tail’ of return on investment) and incorporation/adoption via M&A (an activity that often needs significant outside capital to execute) both decreases.

Impacts to Investments and the Balance Sheet

Now let’s consider the asset side of the balance sheet. Finance tells us that the value of an asset is the present value of the future cash flows from that asset. So, if we buy a piece of equipment, the value (not the cost) of that asset is the present value of the cash that the asset can generate over time. Lower interest rates mean higher present values, we know this, but what’s more interesting is the time horizon for repayment. With low interest rates you can look farther into the future for those cash flows to pay back and provide a return on that asset. This is one suggested justification for why there was so much investment in capex and tech when interest rates were low - it was easier to justify the purchase when you look farther into the future for cash flow on the investment.

Now consider what happens with assets and capex as rates rise. Again, the obvious observation is that the present value of those assets shrinks. The more interesting observation is that the time horizon on the cash flow from those assets condenses. Remember that higher rates condense time horizons.

For both sides of the balance sheet, for debt and equity, the impact of higher rates is a shrinking of the time horizon and a compression of time. With higher rates, the value of an investment is more weighted towards its ability to generate cash flow today, not next year. When you condense the time period and when you shrink the horizon, your focus shifts to the here-and-now.

Shortened Horizons / Increased Accountability

And this is the heart of this behavioral impact. This is the most important observation about the impact of the current rate environment on small business owners today. The same energy and focus that was spent on a five-year plan is now focused on a twelve-month plan. Sales hires that were given nine months to ramp up are now given three months. New initiatives that were given years to mature are given twelve months. Investments need to show return faster. Payback needs to occur sooner. Planning hasn’t gone out the window, instead the focus of planning has been on shorter time periods. Our planning sessions with clients are shorter-term. The time period in focus is condensed.

This change in the time horizon, this change in focus has manifested in a noticeable increase in focus on team accountability. We are being tasked with initiatives such as ‘reporting on sales team performance’ or ‘holding teams accountable to bookings targets’ more than we ever have been in the past. For clients in the people-business space, there has been a renewed focus on time tracking and weekly reporting of utilization. More than in the past we are being asked to run ‘stress test scenarios’ in case bookings or sales don’t meet targets. Conversations around increasing employee compensation have fallen to the wayside and in its place, we’re having conversations about performance management.

Lastly, working capital and short-term assets are taking more focus and attention than long-term investments and capex with our clients. With so few hours in a working week, fewer hours are spent talking about investing in equipment or new tech and more time is spent focusing on the obvious drivers of today’s cash balance. There is a newfound attention on accounts receivable, accounts payable, and inventory. Our clients are focusing efforts on better collections, extending A/P terms, and implementing better inventory management practices. Lastly, there has been a renewed focus on client prepayments and incentivizing prepayments, deposits, faster payment terms, or even in-process billing vs. completion invoicing.

Conclusion

Erasmus said ‘in the land of the blind, the one-eyed man is king.’ In today’s business world an owner, founder, or leader doesn’t necessarily have to think big thoughts about ‘long-term strategic initiatives’ to be successful or out-maneuver competitors. Those that are blind to the basic and boring elements of today can be out maneuvered, side stepped, and bested. Holding people accountable is back on the table and it’s no longer ‘short-sighted’ to focus on profit and cash flow over revenue growth. Today, there is more value in focusing on these seemingly boring issues than there has been in over fifteen years, and this is providing fertile ground for those willing to put in the effort.

-Kyle Benusa, Jack Allen